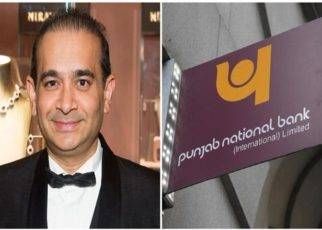

The governance practices in Public Sector Banks (PSBs) are now in question following the Rs 11,400-crore Punjab National Bank (PNB) fraud by billionaire Nirav Modi in collusion with few bank employees. It is questioned why such entries function and how. A political blame game has started as various process failures of public sector banks have become frequent.

However, this is the first time in the country questions are being raised about RBI’s supervisory capacity and systems as why such scam fails to get detected.

Now it is the call laws which govern the Reserve Bank of India functioning need to be changed so that more transparency and accountability are in forefront. Scrutiny into its functioning is also required.

Nirav Modi is one of the richest men in India and deals in diamonds and pearls. He was at number 85 on the list of Forbe’s 2017. He has dressed Bollywood as well as Hollywood including actors like Priyanka Chopra and Kate Winslet and Priyanka Chopra.

Nirav Modi is just 47-year-old and one of the youngest richest person in the country.

Punjab National Bank alleges Nirav Modi worked with one of their former employees named Gokulnath Shetty, deputy general manager in the foreign-exchange department, in a PNB branch in Mumbai, the place of origin of the fraud. Shetty then looked after import payments.

In January 2017 the jeweller’s company approached PNB for a fresh loan, but successor of Shetty declined to honor the request. Shetty has retired. PNB says investigation is under process.